Overview

Understandably, identity theft was a main security concern for 74% of the 5,000 individuals we surveyed about safety and security issues. Frighteningly frequent data breaches may leave you at risk for identity theft, but thorough identity monitoring services can help you catch issues before they escalate.

Best Identity Theft Protection Services of 2022

Data from a 2019 proprietary survey.

Best identity theft protection services

- IdentityForce: Best Overall

- Zander: Best budget protection

- IdentityIQ: Best flexibility

- IDShield: Best availability

- Identity Guard: Best transparency

How we chose

We researched 17 of the most prominent identity theft protection services. We tracked the features each brand offers and at what price, then ranked each by customer service, product, and price. We then averaged out the rankings to see which brands came out on top.

Finally, we considered non-quantifiable factors like reputation and personal experiences with the brands.

Compare best identity theft protection services

| Brand name | IdentityForce | Zander Insurance | IdentityIQ | IDShield | Identity Guard |

|---|---|---|---|---|---|

| Best for | Best overall | Best budget protection | Best flexibility | Best availability | Best transparency |

| Monthly price range (individual coverage) | $17.95–$23.95 | $6.75 | $9.99–$29.99 | $14.95–$19.95 | $8.99–$29.99 |

| SSN monitoring | Yes | Yes | Yes | Yes | No |

| Change of address verification | Yes | Yes | Yes | Yes | Yes |

| Lost/stolen wallet assistance | Yes | Yes | Yes | Yes | No |

| Bank/credit account alerts | Yes | No | Yes | No | Yes |

| Credit monitoring | Yes | No | Yes | Yes | Yes |

| Medical record protection | Yes | Somewhat | No | ||

| Mail list removal | Yes | No | Yes | No | No |

| Credit bureaus checked | All 3 | None | All 3 | 1 to 3 | All 3 |

| ID theft insurance amount | $1 million | $1 million | $1 million | $1 million | $1 million |

| Family plan available | |||||

| Learn more | |||||

| +1-866-208-1199 | Read Review | Read Review | Read Review | Read Review |

Data effective 7/1/2022. Offers and availability subject to change.

Best overall: IdentityForce

IdentityForce pros and cons

Free 30-day trial

Annual payment discount

Customizable banking alerts

Medical ID fraud protection

Anti-phishing and anti-keylogging software

Easy mobile access with app

Three-bureau credit monitoring (higher-tier package)

24/7 customer service

Slightly higher price

Irrelevent alerts

Why we recommend IdentityForce

IdentityForce is our top recommendation because it offers the best protection for the cost. For the midrange price you get more coverage than you would from anywhere else.

How much does IdentityForce cost?

| Individual plans | UltraSecure | UltraSecure + Credit |

|---|---|---|

| Monthly price | $17.95 | $23.95 |

| SSN monitoring | Yes | Yes |

| Change of address verification | Yes | Yes |

| Lost/stolen wallet assistance | Yes | Yes |

| Bank/credit account alerts | Yes | Yes |

| Credit monitoring | No | Yes |

| Medical record protection | Yes | Yes |

| Mail list removal | Yes | Yes |

| Court record monitoring | Yes | Yes |

| Dark web monitoring | Yes | Yes |

| Social media monitoring | Yes | Yes |

| Credit score simulator | No | Yes |

| Credit bureaus checked | – | 3 |

| Learn more |

Data effective 9/6/2022. Offers and availability subject to change.

IdentityForce isn’t the priciest protection from identity thieves, though it’s the priciest one we recommend. It has comprehensive coverage for the price, and it also has the best-reviewed customer service of any brand we researched. That’s worth paying a little extra.

You can also get three months free when you sign up for an annual plan. Worried about locking yourself into a service for a whole year? The free 30-day trial gives you time to test the service before committing.

Features

IdentityForce offers some of the most complete monitoring services and protection we’ve seen.

Here are a few of the more unusual offerings:

- Court record monitoring: See if someone’s using your identity to commit a crime.

- Dark web monitoring: Make sure your info isn’t being illegally sold.

- Removal from mailing lists: Limit annoying (and potentially dangerous) spam.

- Social media account monitoring: Look for suspicious or inappropriate content on or adjacent to your social media to protect yourself from scammers and hackers.

- Medical identity theft protection: Keep your health information secure so that no one can illicitly run up medical charges under your name.

These features make the slightly higher price worth it.

IdentityForce doesn’t officially have family plans. But if you call a rep directly to buy a plan, you may be able to snag coverage for your kids regardless.

Financial alerts and credit monitoring

Identity thieves can hit your finances hard, so we like IdentityForce’s financial support tools. The base plan includes customizable banking and credit card alerts. That means you’ll get a notification if a transaction, withdrawal, or balance transfer exceeds whatever amount you set.

These real-time alerts may not prevent identity theft, but they help you catch suspicious activity early. You can then work with IdentityForce to initiate a credit freeze or other defensive measures.

If you spring for the UltraSecure+Credit package (and we suggest you do), you’ll also get full-blown credit monitoring from all three credit bureaus. This gives you regular access to your credit reports and scores. You can get annual reports for free, but IdentityForce lets you check your credit report all year long. That’s so much easier for monitoring your finances.

UltraSecure+Credit also includes a credit score simulator, which lets you see how certain scenarios could impact your score. This is super helpful if you want to test out ideas for improving your credit before getting a car loan or mortgage.

Customer service

We’re impressed with IdentityForce’s customer service. The brand reps can be reached 24/7 through chat, email, or phone. Customer reviews of the service are mostly positive, and there are no Better Business Bureau complaints. The only issue we frequently saw in reviews was that customers get a lot of sexual predator alerts from IdentityForce’s database. You can customize your alerts if you don't find them useful, though.

ASecureLife’s recommendation: IdentityForce offers the most identity theft protection service features at an extremely affordable price. We recommend the UltraSecure+Credit package so you can keep an eye on your credit and prevent identity theft at the same time.

Best budget protection: Zander

Zander pros and cons

Affordable individual and family plans

Great reputation and Dave Ramsey endorsement

Recovery expense reimbursement (including lost wages)

Some medical record protection

24/7 customer service

No credit monitoring

No mobile app

Less ID monitoring than other services

Why we recommend Zander

Zander focuses more on insurance than monitoring. But affordable insurance is a wise option if you can’t afford traditional identity theft protection. Plus, you still get basic identity monitoring services for your Social Security number, driver’s license number, and banking accounts.

The main downside is that you can’t get credit monitoring. But at such a low price, we think that’s fair. The insurance coverage is solid, and Zander’s recovery services are excellent. And Zander representatives will work with you to for up to three years after your case is closed to keep your identity protected.

How much does Zander cost?

Zander Insurance comes in at $6.75 per month, which includes:

- SSN monitoring

- Change of address verification

- Lost/stolen wallet assistance

- Some medical record protections

Zander’s plans are ridiculously affordable. And since ID theft is a real possibility, insurance is a smart investment.

- Individual plan: $6.75 a month

- Family plan: $12.90 a month (plan includes you, your spouse, and unmarried dependents up to age 25)

With this family plan, you can add all your kids and still pay just $12.90 monthly. Even if you have a Weasley-sized family or bigger, you’re covered.

Despite the bargain pricing, Zander’s plans come with $1 million in insurance coverage—the same amount you’d get with a more expensive service.

Features

Zander doesn’t have as many features as other brands. That’s largely because the service is designed to assist you after your identity is stolen, not protect you preemptively.

Zander does offer partial medical record protection. The brand doesn’t monitor your medical records for you, but if your identity is stolen, Zander will alert your medical provider alongside tax and financial institutions.

Protected Health Information (PHI) is like a huge red target for identity thieves, which is why it’s such a plus to have covered. IdentityIQ, IDShield, and Identity Guard don’t currently offer protection for medical records. Without protection, you could be vulnerable to an identity thief opening medical billing accounts or receiving prescriptions in your name.

Customer service

Zander customer service is available through phone, email, and fax at any time of day or night.

ASecureLife’s recommendation: Zander’s the best option for your wallet. The individual and family plans are both great deals.

Why we recommend IdentityIQ

When it comes to flexibility in identity theft protection plans, IdentityIQ is king. The brand has three plans under $30 so you can get the coverage you want at the price you want.

How much does IdentityIQ cost?

| Individual plans | Secure Plus | Secure Pro | Secure Max |

|---|---|---|---|

| Monthly price | $9.99 | $19.99 | $29.99 |

| SSN monitoring | Yes | Yes | Yes |

| Change of address verification | Yes | Yes | Yes |

| Lost/stolen wallet assistance | Yes | Yes | Yes |

| Bank/credit account alerts | Yes | Yes | Yes |

| Credit monitoring | Yes | Yes | Yes |

| Mail list removal | Yes | Yes | Yes |

| Crime alerts | No | Yes | Yes |

| Credit score simulator | No | No | Yes |

| Credit bureaus checked | 1 | 3 | 3 |

| Learn more |

Data effective 9/06/2022. Offers and availability subject to change.

Features

We like that IdentityIQ has a credit score simulator. It’s a perfect way to calculate how your financial decisions will affect your credit. IdentityForce is the only other brand on this list to offer this helpful feature. Ditto with junk mail list removal.

With its higher-tier packages, IdentityIQ also alerts you when a crime’s committed in your name. Whether someone is fraudulently using your identity or they happen to share your name, it’s useful to know of crimes that may be attributed to you. You can report fraud or inform any prospective employers of the situation ahead of time to avoid misunderstandings.

Customer service

A big downside to IdentityIQ is the limited customer service hours.

You can call IdentityIQ from 8 a.m. to 6 p.m. CT Monday through Friday or 8:30 a.m. to 5:30 p.m. CT on Saturdays. If you work during those hours or need assistance on a Sunday, you’re out of luck.

If you want a brand with longer service hours, IdentityForce is a safe bet.

ASecureLife’s recommendation: If you want your identity theft protection your way, try IdentityIQ. We’d recommend going with at least the Secure Pro Plan for three-bureau monitoring.

Why we recommend IDShield

IDShield’s price isn’t terrible, though it’s a little higher than usual for what’s included. We think the standout features for this brand are its private investigators and emergency after-hours phone line.

How much does IDShield cost?

| Individual plans | One bureau | Three bureau |

|---|---|---|

| Monthly price | $14.95 | $19.95 |

| SSN monitoring | Yes | Yes |

| Change of address verification | Yes | Yes |

| Lost/stolen wallet assistance | No | No |

| Credit monitoring | Yes | Yes |

| Social media monitoring | Yes | Yes |

| Private investigators | Yes | Yes |

| Credit bureaus checked | 1 | 3 |

| Learn more |

Data effective 9/6/2022. Offers and availability subject to change.

Features

IDShield doesn’t currently offer bank account alerts, one of the most basic identity theft protection offerings. But it has private investigators at its disposal with both plans. The investigators operate out of Oklahoma and have jurisdiction to pursue claims across the United States. These PIs are for identity theft recovery purposes only, not for tracking down your long-lost family members or yesteryear’s romantic interest. Still, we think it’s a neat service.

IDShield also offers social media monitoring. With this monitoring, parents can track certain words or phrases that their kids use on Twitter, Facebook, and Instagram. This lets you know if your kids are talking about drugs, alcohol, or sexual content; using age-inappropriate language; or the victims or perpetrators in cyberbullying.

You can also get a family plan for IDShield by adding $13 to the one-bureau plan or $15 to the three-bureau plan. The family plans cover two adults and up to ten dependent children.

Customer service

Like IdentityIQ and Identity Guard, IDShield has limited customer service hours. The reps take calls from 7 a.m. to 7 p.m. CT on weekdays. But if you need support before or after those hours on Monday through Friday or on weekends, you can call their emergency after-hours support line.

In some ways, having an emergency line is better than having 24/7 standard service. The customer service rep already knows that your situation is urgent before they pick up the phone.

You can also contact IDShield through email, Facebook, and Twitter. So if unsynchronized communication is better for you, you have multiple channels to choose from.

ASecureLife’s recommendation: If you’re concerned about the limited customer service hours of other brands, IDShield deserves your consideration. We recommend the three-bureau plan for the most comprehensive coverage.

Best transparency: Identity Guard

Identity Guard pros and cons

Annual payment discount

Family plan available

Easy mobile access with app

Safe browsing extension

Social insight report

Three-bureau credit monitoring (higher-tier packages)

Limited customer service hours

No stolen wallet assistance

No credit monitoring with cheapest plan

Why we recommend Identity Guard

We’ve researched identity theft protection services for hours and hours, but some of the processes they use are still a mystery to us. Not Identity Guard’s though.

Identity Guard is unusual because it shares its exact method used for detecting identity theft signs. It proudly touts its use of IBM’s Watson with transparency we haven’t seen in other brands.

How much does Identity Guard cost?

| Individual plans | Value | Total | Ultra |

|---|---|---|---|

| Monthly price | $8.99 | $19.99 | $24.99 |

| Change of address verification | Yes | Yes | Yes |

| Bank/credit account alerts | Yes | Yes | Yes |

| Credit monitoring | No | Yes | Yes |

| Credit reports | No | No | Yes |

| Safe browsing extension | Yes | Yes | Yes |

| Social insight report | No | Yes | Yes |

| Credit bureaus checked | – | 3 | 3 |

| Learn more |

Data effective 9/6/2022. Offers and availability subject to change.

Features

Aside from the use of Watson, Identity Guard is notable for its safe browsing extension. This extension offers a measure of protection from online scams and viruses that steal passwords and other information—a less common way for identity theft to occur. You can use the extension on Chrome, Firefox, or Safari.

Identity Guard also offers a social insight report (a type of social media monitoring). Watson assesses your Facebook timeline and recommends changes for a better online reputation. As far as we can tell, this doesn’t prevent identity theft, but it’s beneficial if anyone ever runs a social media background check on you.

Identity Guard doesn’t have a stolen wallet assistance feature for a stolen purse, wallet, or credit card. But its credit monitoring services can help track any suspicious activity following the theft.

Finally, Identity Guard’s family plans run from $14.99 to $34.99. This family plan covers “all adults and children residing in one househould,” according to their website. The brand used to specify the number of adults and children, so we’re guessing that the wording change was deliberate. If your aging parents or other people live with you, this family plan could be just the thing.

Customer service

Identity Guard’s customer service reps have limited hours. So if you have an issue, you’ll have to call Monday through Friday from 8 a.m. through 11 p.m. ET or Saturday from 9 a.m. to 6 p.m. ET.

We appreciate that the weekday hours start early enough and run late enough to give access outside of regular business hours when many people work. But if Sunday’s your only day off, you’ll have a hard time getting on-the-phone help from Identity Guard. You can still email though.

ASecureLife’s recommendation: Identity Guard is perfect if you want to know exactly how your information is monitored. We like the Total Plan. You don’t get credit reports, but you do get credit monitoring, so you’ll know if someone messes with your credit.

Other brands we considered

Wondering what popular services didn’t make the cut? Here’s some info.

LifeLock

LifeLock is a big-name identity theft protection service. It’s featured in reviews on all kinds of sites. But LifeLock is an average deal, price-wise. You pay a decent amount of money without getting as much back for it as you do with IdentityForce or IdentityIQ.

Experian IdentityWorks

Experian has its fingers in a lot of different identity theft protection offerings. In the past, we’ve recommended IdentityWorks as both our favorite Experian service and a top-ranked service overall. It has good family plans and good credit monitoring from all three bureaus. What’s not to love?

Poor customer service, that’s what. Experian’s current online reviews are overwhelmingly negative. It also has a recent class-action lawsuit involving inaccurate credit reports.

ID Watchdog

ID Watchdog is relatively well-known. But for its price, you don’t get many features. The brand also has mostly negative online reviews.

We think your money would be better spent elsewhere. The only exception is if you’re a healthcare professional. ID Watchdog offers a unique service to ensure thieves aren’t using your medical credentials to defraud patients.

CompleteID (through Experian)

CompleteID, one of Experian’s offerings, is exclusive to Costco members. People with an Executive Member card pay $8.99 a month, while Business and Gold Star members pay $13.99. It’s a decent deal: the coverage through CompleteID is comparable to IdentityIQ.

So should you get a side of identity theft protection with your well-priced gas and dollar churros? Sadly, like LifeLock, CompleteID monitors through Equifax, making it a no for us.

ReliaShield

ReliaShield is newer on the scene and has been getting a bit of buzz. It has standard offerings for an okay price, though at $47.99 a month, its highest-tier family plan costs more than any identity theft protection service we’ve seen. The main obstacle that kept us from ranking this service was the lack of reviews. Not many customers are talking about their experience with ReliaShield, so it’s hard to assess the company accurately right now.

Identity Theft Protection Services FAQ

What should you look for in an identity theft monitoring service?

We’ve put together a list.

- Social Security number monitoring: Any good identity theft protection company should monitor your Social Security number. Your SSN is associated with government records, bank accounts, medical information, and more.

- Insurance and recovery assistance: Identity theft protection can prevent your identity from being stolen. It can also help you catch the ID thief early and recover quickly. Choose a company that offers both insurance and recovery assistance so that you have help dealing with ID theft—not just preventing it.

- Database and website monitoring: It’s nearly impossible to go through online databases and watch suspicious websites on your own. To keep your limited time intact, the identity protection company you choose should offer this service.

- Lost/stolen wallet assistance: Protection from everyday risks is just as important as protection from big data breaches. Your identity may never be stolen, but it’s still easy to misplace your wallet or purse. We recommend choosing a company that will help you replace or cancel your driver’s license, credit cards, and debit cards if your wallet is lost or stolen.

- Mobile alerts: If your security is jeopardized, you should know about it as quickly as possible. If your ID theft protection service offers mobile alerts, you can immediately start taking steps to secure your accounts.

- Basic credit monitoring: Look for a service that includes at least some level of credit monitoring since identity theft can have a serious impact on your credit and finances.

How to prevent identity theft

Be careful with the information you give away. If a service asks for your Social Security number, ask, “Do you really need that?” Here’s a hint: your SSN is mandatory for credit card applications, some large transactions, some federal benefits, and the DMV.3 You may also have to provide it to your employer for a background check, depending on where you live and what job you’re applying for.4 But you don’t even have to give it to your doctor’s office.

Also, be careful what you add on social media. With the rise of financial tie-ins on these sites, like Facebook’s Libra, more and more of your sensitive information may find itself in a single place.

In the end though, identity theft happens because of people who are okay with hurting others. Identity thieves actively seek out your information, and they don’t feel guilty about it. They might be able to steal your identity not because you’ve done anything wrong in handling your information. They’re choosing to do something wrong by hacking a database or stealing PHI from their workplace.

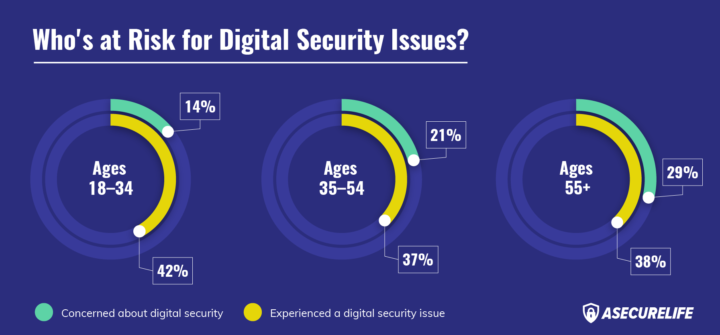

Who’s most at risk for identity theft?

Kids are definitely at risk, as we mentioned earlier. Their Social Security numbers are exceptionally tempting to thieves since they’re not being used much until they get older. But older adults are often targets too. They may be more trusting or less likely to notice if something’s amiss.

Data from a 2019 proprietary survey.

When do you need an identity theft protection service?

Identity theft protection services are most effective before your identity is stolen, although we suspect many customers sign on after that happens.

Overall, the earlier you sign up the better.

Here’s another reason to sign up ASAP with an identity service. A few customer reviews across different brands mentioned having the same experience: someone else signed up for an identity theft protection service using the reviewer’s identity. We suspect that the thieves were trying to muddy the waters by protecting their stolen identities. If someone signs up for an identity theft protection service with your information, you can work with the company to wrest control of the account. But it’s far easier to prevent this by already being signed up with a service.

Where could an identity thief access your personal information?

You might think that your identity is secure. You never post anything personal online, not even your address for wedding invitations. You don’t even shop on Amazon or use a credit card at Target.

Unfortunately, your identity could still be up for grabs. If your healthcare provider has a data breach, for example, your medical records are vulnerable. You can’t guarantee that your information will stay 100% secure no matter how careful you are.

Data from a 2019 proprietary survey.

How much could identity theft cost me?

Identity theft can pose a major financial threat, depending on the information the identity thief compromises. That's why most identity theft protection companies offer high-dollar values in insurance in case your information is stolen.

>>Check out which states have the highest identity theft costs per capita.

Our recommendation

Here are the identity theft protection services that we recommend and why:

- IdentityForce: We recommend IdentityForce’s UltraSecure+Credit plan for most people because it offers serious protection and detailed monitoring at a fair price.

- Zander: Need a lower-cost option? At less than $7 a month, Zander Insurance could be just what you need.

- IdentityIQ: If you want a little flexibility in your price and service level, IdentityIQ has an excellent range.

- IDShield: Email, use Facebook or Twitter, or call at any time to reach IDShield customer service.

- Identity Guard: Identity Guard makes ID protection services less mysterious by advertising its use of Watson.

Don’t put off getting identity theft protection. For more help with protecting your identity, read What to Do If Your Identity Is Stolen.

Sources:

- The New York Times, “Actors and Their Roles for $300, HAL? HAL!”

- IBM, “The DeepQA Research Team”

- CreditCards.com, “When You Should, Shouldn’t Give Out Your Social Security Number”

- The Balance Careers, “Listing Social Security Numbers on Job Applications”